Help:AP1-Print 1099 Selections: Difference between revisions

No edit summary |

mNo edit summary |

||

| (3 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

__NOTITLE__ | |||

{{Page title|Print Form 1099-Misc Selections }} | |||

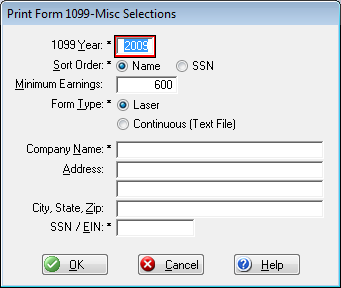

This window titled ''Print Form 1099 Misc Selections'' enables you to enter the necessary information for the proper printing of the forms 1099-MISC. | This window titled ''Print Form 1099 Misc Selections'' enables you to enter the necessary information for the proper printing of the forms 1099-MISC. | ||

[[File:Print_Form_1099-Misc_Selections.png]] | |||

'''The | {{Important tip|tip='''The MoverBiz System only prints Forms 1099-MISC. All other types of 1099 forms (INT, etc.) must be manually prepared.''' | ||

''' | ''' Forms 1099-MISC for Commission Agents MUST be printed in the Commissions Manager module, NOT in the Accounts Payable Manager module.'''}} | ||

'''Year:''' Enter the calendar year for which you wish to print the forms 1099-MISC. | '''Year:''' Enter the calendar year for which you wish to print the forms 1099-MISC. | ||

'''Sort Order:''' The IRS permits that these forms be sorted in one of two ways, as explained below. Point your mouse cursor to the radio button for the desired Sort Order and left-click your mouse one time to select that option. | '''Sort Order:''' The IRS permits that these forms be sorted in one of two ways, as explained below. Point your mouse cursor to the radio button for the desired Sort Order and left-click your mouse one time to select that option. | ||

| Line 14: | Line 17: | ||

'''SSN''' Press this radio button if you wish to print the forms in Social Security Number order. | '''SSN''' Press this radio button if you wish to print the forms in Social Security Number order. | ||

'''Minimum Earnings:''' Enter the minimum amount paid for which you are required to send a form 1099-MISC. The current regulation requires that they be sent to any non-corporation whose payments have been $600.00 or more in the calendar year. Check with your accountant or CPA for the minimum payment limit to enter in this field. (NOTE: Please note that this field automatically defaults to 600 for $600.00. You may override this amount if necessary.) | '''Minimum Earnings:''' Enter the minimum amount paid for which you are required to send a form 1099-MISC. The current regulation requires that they be sent to any non-corporation whose payments have been $600.00 or more in the calendar year. Check with your accountant or CPA for the minimum payment limit to enter in this field. (NOTE: Please note that this field automatically defaults to 600 for $600.00. You may override this amount if necessary.) | ||

'''Form Type:''' Press the radio button for the desired type of form, as explained below. Point your mouse cursor to the radio button for the desired Form Type and left-click your mouse one time to select that option. | '''Form Type:''' Press the radio button for the desired type of form, as explained below. Point your mouse cursor to the radio button for the desired Form Type and left-click your mouse one time to select that option. | ||

| Line 26: | Line 27: | ||

'''Electronic''' Press this radio button if you wish to create a file for electronic submission to the IRS. For additional information regarding this option, please see [[Print 1099 Forms Electronically]]. | '''Electronic''' Press this radio button if you wish to create a file for electronic submission to the IRS. For additional information regarding this option, please see [[Print 1099 Forms Electronically]]. | ||

'''Company Name:''' Enter the official name of your company in this field. This name will print on the form 1099-MISC and it should be same name that was used to obtain the EIN number from the IRS. | '''Company Name:''' Enter the official name of your company in this field. This name will print on the form 1099-MISC and it should be same name that was used to obtain the EIN number from the IRS. | ||

Latest revision as of 20:35, 12 April 2010

This window titled Print Form 1099 Misc Selections enables you to enter the necessary information for the proper printing of the forms 1099-MISC.

Year: Enter the calendar year for which you wish to print the forms 1099-MISC.

Sort Order: The IRS permits that these forms be sorted in one of two ways, as explained below. Point your mouse cursor to the radio button for the desired Sort Order and left-click your mouse one time to select that option.

Name Press this radio button if you wish to print the forms in Sort-Locator order.

SSN Press this radio button if you wish to print the forms in Social Security Number order.

Minimum Earnings: Enter the minimum amount paid for which you are required to send a form 1099-MISC. The current regulation requires that they be sent to any non-corporation whose payments have been $600.00 or more in the calendar year. Check with your accountant or CPA for the minimum payment limit to enter in this field. (NOTE: Please note that this field automatically defaults to 600 for $600.00. You may override this amount if necessary.)

Form Type: Press the radio button for the desired type of form, as explained below. Point your mouse cursor to the radio button for the desired Form Type and left-click your mouse one time to select that option.

Laser Press this radio button if you wish to print these 1099-MISC forms on a laser printer.

Continuous (Text File) Press this radio button if you wish to print these 1099-MISC forms on continuous feed forms in a dot-matrix printer.

Electronic Press this radio button if you wish to create a file for electronic submission to the IRS. For additional information regarding this option, please see Print 1099 Forms Electronically.

Company Name: Enter the official name of your company in this field. This name will print on the form 1099-MISC and it should be same name that was used to obtain the EIN number from the IRS.

Address, City, State, Zip: Enter your company's Address, City, State, and Zip Code. These fields will print on the form 1099-MISC.

SSN / EIN: Enter your company's Employer Identification Number as assigned by the IRS. This is required to be printed on the form 1099-MISC.

[ OK ] Press this button to start the selection process.

[ Cancel ] Press this button to cancel this operation, close this window, and return to the previous window.

[ Help ] Press this button (if available) or the F1 key to view the Help text for this window.